The insurance sector is undergoing a pivotal shift with stiff competition and changing customer expectations demanding a rejig of operating models. Insurers need to shed their reliance on manual operations and create digital, connected, intelligent processes and systems. However, a shift of this magnitude is not an easy task. So, what can insurers do to stay competitive, and what role will artificial intelligence (AI) play in this journey? Read the article to find out.

Deep into the battle for the consumer, the insurance industry is experiencing a tectonic shift. The rise of nimble AI-first insuretech players and changing customer expectations are keeping insurance leaders on their toes.

While the future may be ambiguous, one thing is clear – the current operating models in insurance are long due for a refresh. What insurers need is speed, accuracy, and efficiency. They need to shed their reliance on manual operations and create digital, connected, intelligent processes and systems. However, a shift of this magnitude is not an easy task. So, what can insurers do to stay competitive, and what role will artificial intelligence (AI) play in this journey?

We spoke with 50+ industry practitioners to understand how this disruptive technology will shape the future of insurance. Here are some key thoughts that resonate across the board:

1. AI will revolutionize product and service templates, improving underwriting accuracy, reducing fraud, and offering superior customer experiences.

2. A surge in the use of chatbots and virtual assistants will deliver near-human experiences for customers improving customer service.

3. AI has the potential to dramatically reduce the cost of insurance and open a whole new market for uninsured individuals who can benefit from affordable coverage.

While there are indeed many benefits, the survey cautions for a measured approach to AI as:

4. AI may lead to greater inequality with biased algorithms denying coverage to specific groups, and hence ethical AI is a key priority.

5. While AI may make some job roles obsolete, it will also create new jobs and lead to greater satisfaction and efficiencies for the workforce.

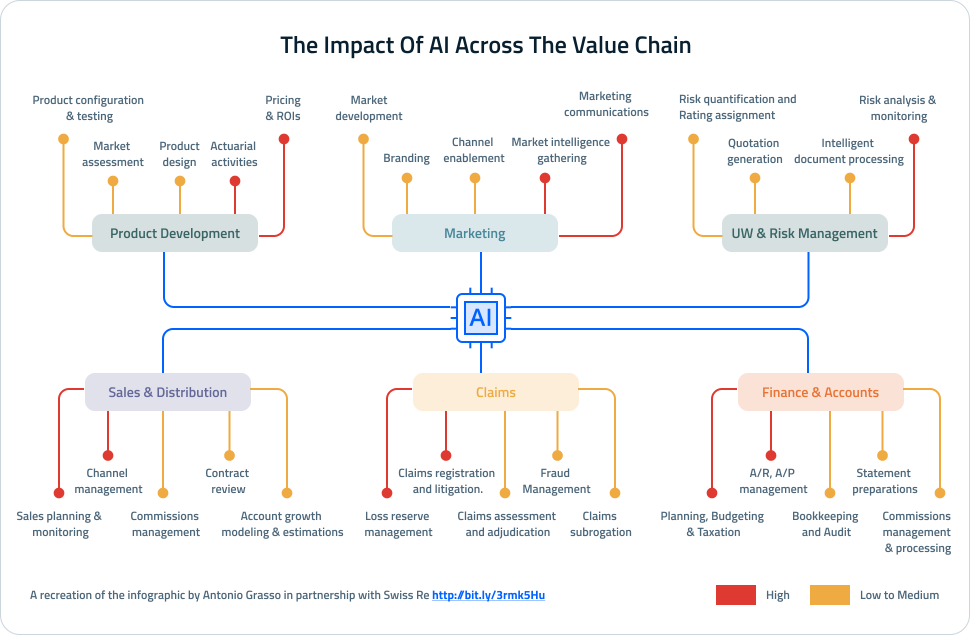

AI’s impact can already be felt across the value chain (See Table) in various degrees

Similarly, a healthcare insurer used intelligent automation to reduce average claim settlement time by 60%, and another transformed customer service with a 15% increase in agent productivity.

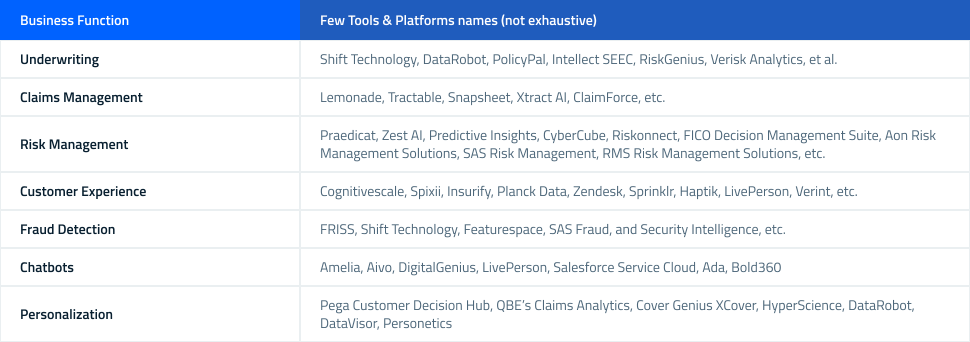

The benefits of AI are obvious, and insurers across the spectrum are rapidly trying to adopt, deploy and use it. While a host of large insurance carriers are currently building AI tools and platforms, their mid-sized counterparts are exploring multiple and motley off-the-shelf AI platforms (See Table).

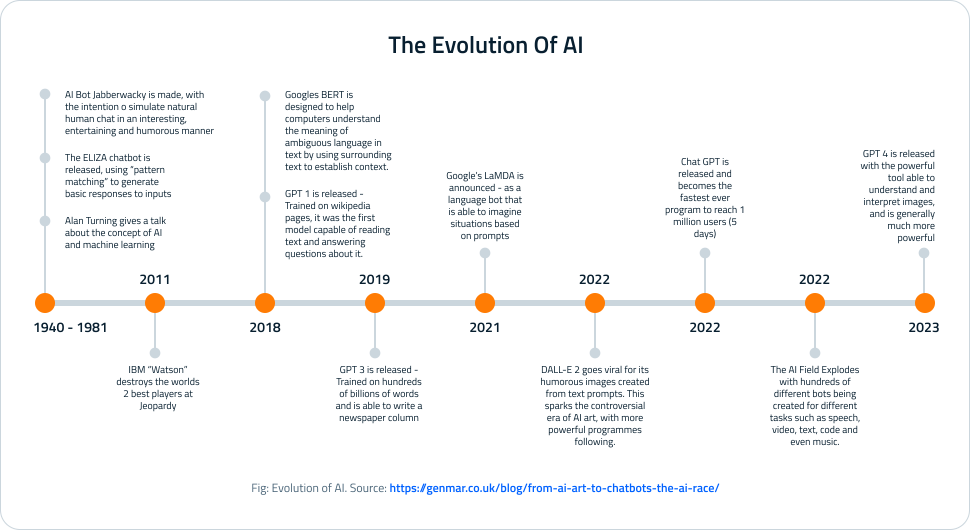

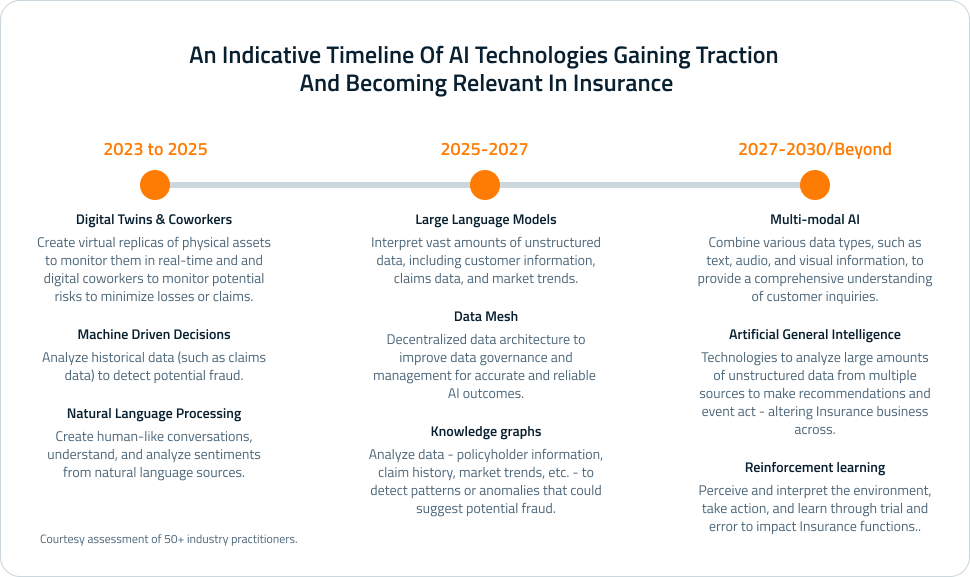

The evolution of AI (See Fig: Evolution of AI), especially the latest advancements, has also spurred new use cases. As the technologies continue to evolve (See Table), insurers are finding interesting applications. For instance, Swiss RE and Microsoft have partnered to explore the potential of digital twins in various use cases, such as analyzing ship risk by simulating part failures1. Another example is one of the world’s largest commercial property insurers, which has been using digital twins to simulate the behavior of insured assets under different scenarios, mitigating risks and estimating reconstruction costs.

Similarly, Liberty Mutual has been using Natural Language Processing to interpret records, assess risks, and devise industry-leading predictive models2. This enables them to deliver enriched claims experience to customers, simultaneously analyzing customer feedback and sentiment, with the potential to reduce attrition and improve NPS. Some insurance industry leaders are already investing in developing Large Language Models to create customized insurance policies tailored to individual risk profiles. One example is a group of mutual insurance companies in the US that are experimenting with LLMs to gain insights into customer interactions and preferences to offer personalized insurance solutions. Noteworthy also, is that InsurGPT, a generative AI model designed specifically for insurance by the upcoming InsurTech Roots Automation, is gaining traction among insurers.

To create a strong foundation for AI, companies like Zurich Insurance3 are exploring the Data Mesh and creating data-as-a-service platforms. This platform enables Zurich Insurance to analyze various data sets, including weather patterns and natural disasters, to assess the risk of insuring properties in specific geographies. This has resulted in the ability to adjust premiums and coverage accordingly, providing a competitive advantage in the industry. For a comprehensive understanding of customer inquiries to serve them better and create better experiences, Lemonade, a new-age insurer, is leveraging some facets of multi-modal AI in its AI Maya and AI Jim bots. It also enables end-to-end self-service by prompting customers to upload home images and videos through the app to process claims, making the process smooth and hassle-free.

Given the potential applications of AI on the horizon, insurance is an exciting space to be in. However, to make these applications possible, insurers really need to get their house in order.

Organizations really need to step up before they can truly realize outcomes from their investments in AI initiatives, and this means setting a stable ground on at least three key areas:

1. Data Infrastructure:

Data is the foundation for AI success. Insurers need a robust data infrastructure for data storage, data integration, and data governance that can handle the volume, variety, and velocity of data required for AI applications. This infrastructure should also ensure data quality, security, and compliance.

2. Data Quality and Accessibility:

High-quality and well-curated digitized data is an absolute must to enable effective AI model training, evaluation, and, finally, to drive applications with outcomes.

3. Regulatory Compliance and Ethical Frameworks:

Companies need to stay updated on emerging regulatory guidelines while simultaneously setting up frameworks to ensure bias mitigation and monitor the explainability of AI model outcomes.

Robust governance and regulation have become non-negotiable as AI adoption increases. While AI has a vast transformative potential, its deployment without adequate oversight can lead to ethical pitfalls. Already we see models perpetuating biases and resulting in discriminatory outcomes. In addition, the extensive data that AI systems require presents significant privacy and security challenges. To build stakeholder trust, there needs to be provisions for data governance and transparency. Beyond ethical considerations, AI missteps could lead to reputational damage and legal liabilities.

Our conversations with 50+ insurance executives highlighted these concerns. Their view is that insurers looking to capitalize on the benefits of this technology must put some guardrails in place. For instance:

1. Prioritize data protection by ensuring customer information is safeguarded against unauthorized access.

2. Monitor AI models to prevent discrimination against protected groups such as gender, race, or age.

3. Be transparent with customers about the decision-making process of the AI model.

4. Seek explicit consent from customers by providing them with specific information about how their data will be used and any potential consequences.

5. Develop processes and systems to audit and monitor the performance of AI models over time to ensure their continued success.

Loved what you read?

Get practical thought leadership articles on AI and Automation delivered to your inbox

Loved what you read?

Get practical thought leadership articles on AI and Automation delivered to your inbox

AI has the potential to forever change the way insurance operates by shifting the focus away from compensating for loss to loss prevention. For instance, in healthcare, it can enable preventive care, changes in nutritional styles, etc., to enable healthier lifestyles and fewer claims. In automotive, it can track and reward good driving behaviors minimizing wear and tear and accidents. And in buildings and facilities, it can enable preventive maintenance to prevent losses due to breakdowns. Better risk decisions, event prediction to reduce losses, etc., can help insurers reduce costs, improve profitability, and enhance customer service while the customers enjoy better coverage at lower premiums.

There is indeed a tectonic shift happening in insurance, and a lot is at stake. Only those companies who will embrace this disruption with open arms, who are willing to break down and reimagine legacy operations, and who are able to create a stable digital foundation will emerge winners in an AI-led future.

Disclaimer Any opinions, findings, and conclusions or recommendations expressed in this material are those of the author(s) and do not necessarily reflect the views of the respective institutions or funding agencies

- https://www.swissre.com/risk-knowledge/driving-digital-insurance-solutions/twins-digital-sixth-sense.html

- https://business.libertymutual.com/wp-content/uploads/2022/08/61-5381_NextGen_PredictiveModeling.pdf

- https://www.zurich.com/en/products-and-services/protect-your-business/commercial-insurance-risk-insights/analytics-to-deliver-new-age-of-insights-and-services-for-customers

- https://www.linkedin.com/posts/antgrasso_ai-insurance-valuechain-activity-7054380193330716672-1jRa/