Personetics Engage – Smart Finance

AI Based Proactive & Personalized Engagement Platform. Predictive Insights & Advice on Day to Day Banking.

Personetics is an AI based proactive & personalized digital engagement platform which enable financial institutions to engage retail, wealth & SME customers with personalized insights, timely advice, contextual services & self-driving finance.

Personetics empowering the bank as the go-to financial partner for the customer. Dramatically increases customers’ engagement & products’ adoption.

Personetics provides, among others, Proactive Personal Insights & Guidance, Self-driving Money Management and SME Cashflow Optimization & Guidance.

Personetics is working with over 40 top tier banks & digital banks in North America, Europe & Asia

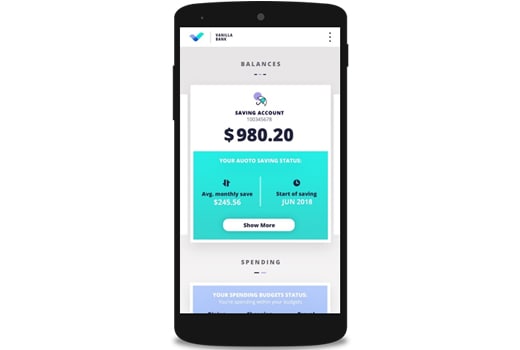

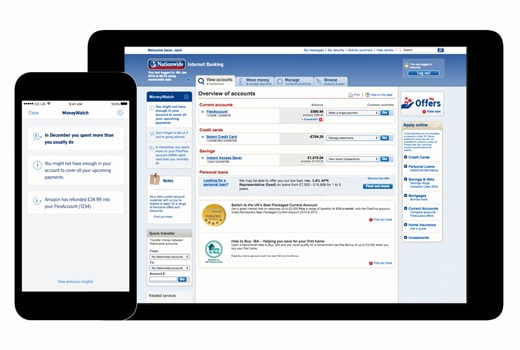

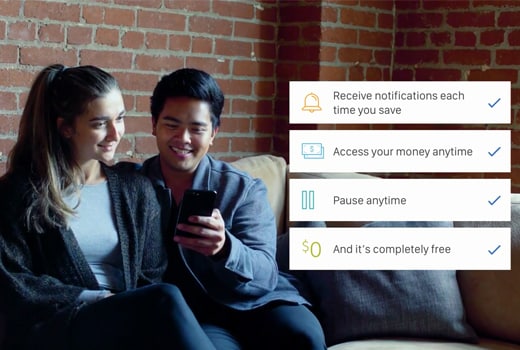

App Screens

Watch & Learn

Nationwide Moneywatch

Wells Fargo Predictive Banking

RBC Nomi

Features

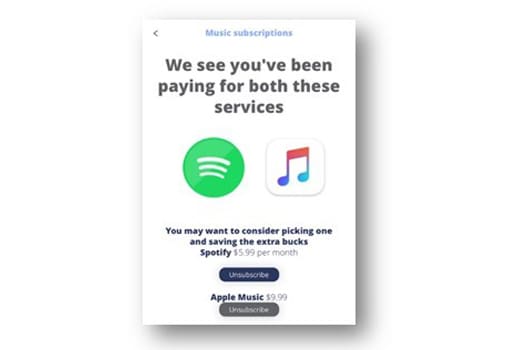

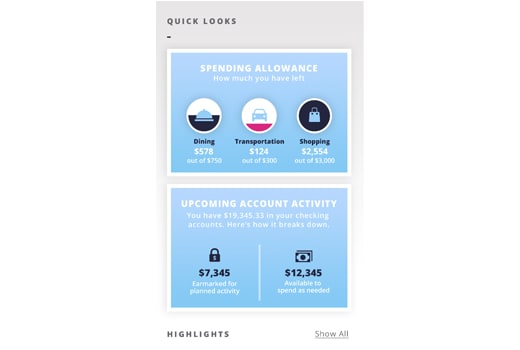

200+ out-of-the-box and verified smart insights

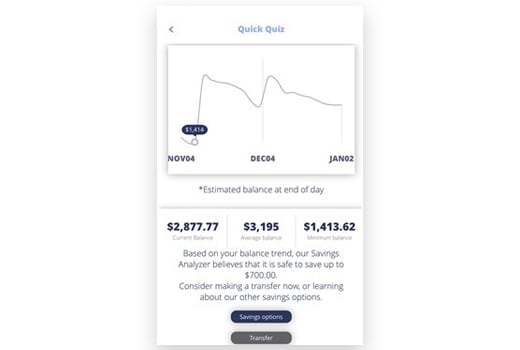

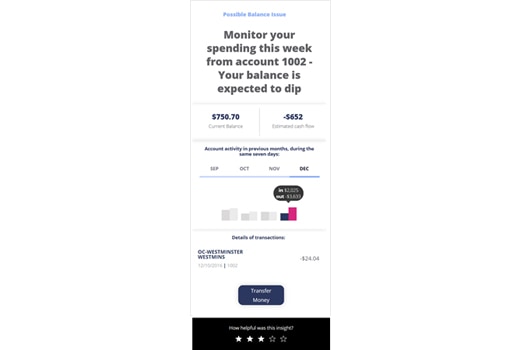

Balance Forecasting

Predicts upcoming activity, forecasts balance and calculates amount leftover

Automated Money Management Programs

Automated Savings, Debt Reductions and Investing Programs

Benefits

Dramatically increases Customers’ engagement & Products’ adoption

2x savings rates for customers that opt-in for automated savings

20-30% higher mobile/digital customer engagement

30%+ improvement in NPS and 45% loyalty lift

Customers consistently rate our insights 4+ on a scale of 1-5

Increase Sales & Balance Growth in 10%-20%

Time to Market: Consumer facing pilot in 3-4 months